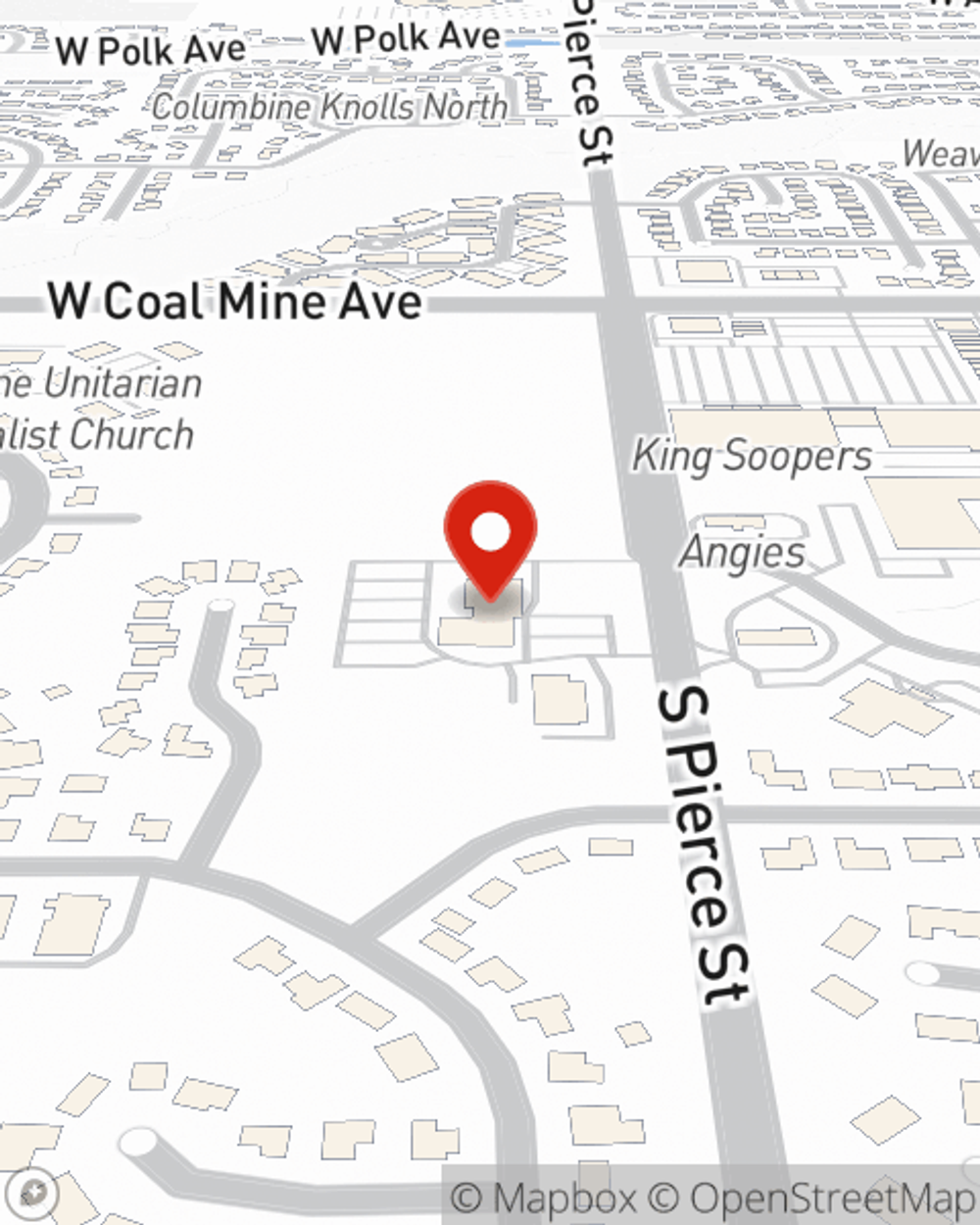

Life Insurance in and around Littleton

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Highlands Ranch

- Centennial

- Denver

- Aurora

- Aravada

- Lakewood

- Greenwood Village

- Lone Tree

- Castle Rock

Be There For Your Loved Ones

It’s common for young people to assume that life insurance is something to think about on down the road. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Littleton, CO, friends and neighbors both young and old already have State Farm life insurance!

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

Life can be just as uncertain when you're young as when you get older. That's why there's no time like the present to get Life insurance and why State Farm offers a couple of different coverage options. Whether you're looking for coverage for a specific time frame or coverage for a specific number of years, State Farm can help you choose the right policy for you.

As a commited provider of life insurance in Littleton, CO, State Farm is ready to be there for you and your loved ones. Call State Farm agent Sean Morton today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Sean at (303) 979-4211 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Sean Morton

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.